MIPS or APMs?

With the advent of MACRA (The Medicaid and CHIP Reauthorization Act of 2015), providers now have a very important choice. The 'doc fix' is dead, but MACRA calls for providers to choose between MIPS and APMs.

What are MIPS and APMs?

Merit-Based Incentive Payment System (MIPS)

The MIPS is a new program that combines parts of the Physician Quality Reporting System (PQRS), the Value Modifier (VM or Value-based Payment Modifier), and the Medicare Electronic Health Record (EHR) incentive program into one single program in which Eligible Professionals (EPs) will be measured on:

- Quality

- Resource use

- Clinical practice improvement

- Meaningful use of certified EHR technology

Alternative Payment Model (APM)

APMs give us new ways to pay health care providers for the care they give Medicare beneficiaries. For example:

- From 2019-2024, pay some participating health care providers a lump-sum incentive payment.

- Increased transparency of physician-focused payment models.

- Starting in 2026, offers some participating health care providers higher annual payments.

Accountable Care Organizations (ACOs), Patient Centered Medical Homes, and bundled payment models are some examples of APMs.

Decision Factors Calculator

The following seven factors are important to consider when making the MIPS vs. APM decision. We've started the calculator with sample data from MedPAC, but you should update these fields to reflect your circumstances.

Clinical Factors

APM Factors

MIPS Factors

Tell me more about the exceptional performance payment adjustment...

In MIPS, clinicians will receive a Composite Performance Score (CPS score) based on their performance on four categories:

- Quality (50%)

- Meaningful use of certified EHR technology (25%)

- Clinical practice improvement (15%)

- Resource use (10%)

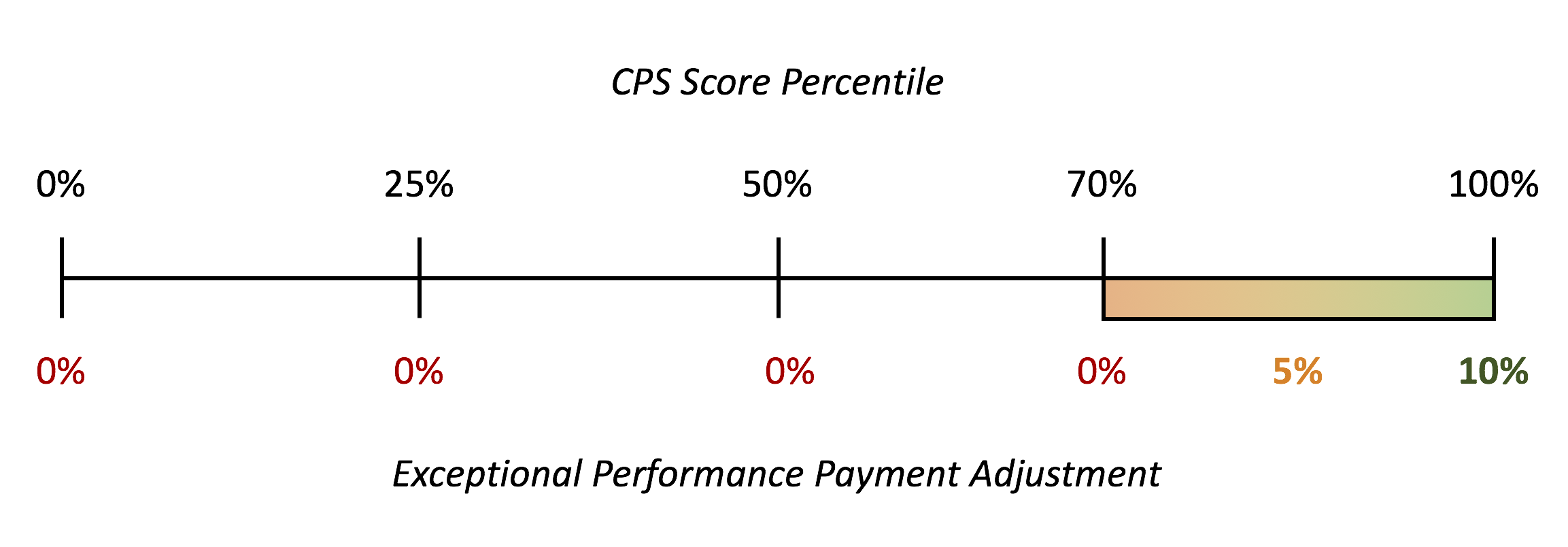

After CPS values are calculated for all Medicare Part B clinicians, the top 30% will receive an "exceptional performance payment adjustment" ranging from 0% to 10%, depending on where they fall within the top 30%.

Adjust this slider bar based on how many clinicians you expect to fall into the top 30% of Medicare Part B clinicians and how they will rank against other clinicians in the top 30%.

Got it - thanks!In MIPS, clinicians will receive a Composite Performance Score (CPS score) based on their performance on four categories:

- Quality (50%)

- Meaningful use of certified EHR technology (25%)

- Clinical practice improvement (15%)

- Resource use (10%)

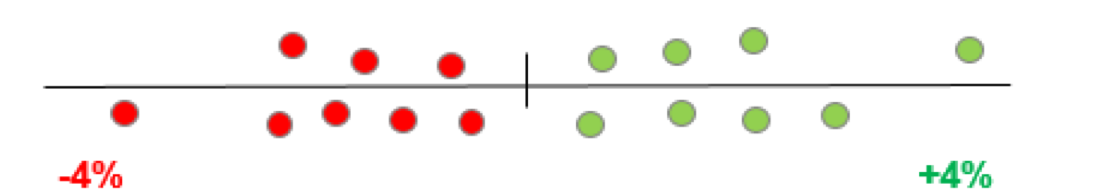

After CPS values are calculated for all Medicare Part B clinicians, the distribution of those scores is taken into account. If more clinicians are receiving penalties than are receiving incentives, the higher-performing clinicians will receive larger incentives.

Budget Neutrality Scale Factor = 1.0

When the distribution of CPS scores is relatively uniform, there will be no scaling of payment adjustments.

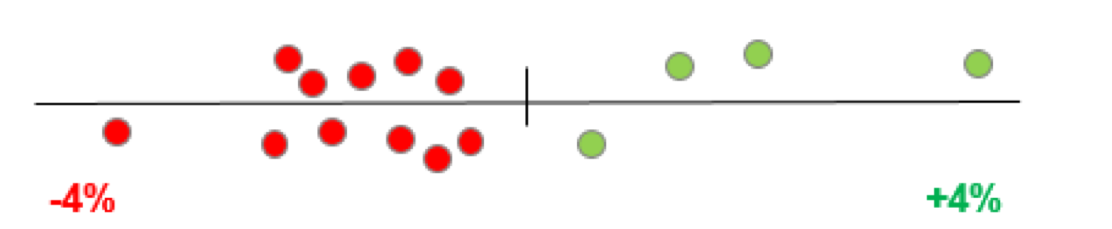

Budget Neutrality Scale Factor = 3.0

When the distribution of CPS scores is more negative, the relatively fewer positive-adjustment clinicians (the 4 green dots on the right) will have their payments scaled up.

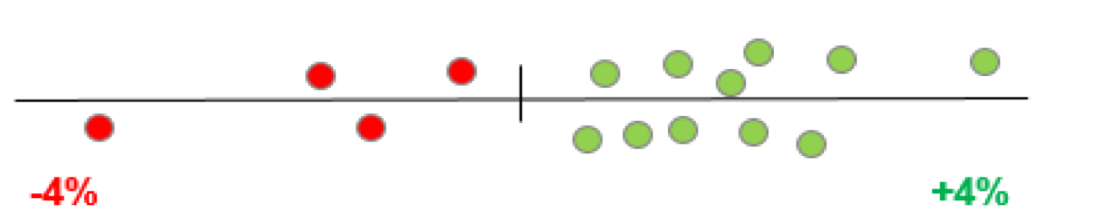

Budget Neutrality Scale Factor = 0.5

When the distribution of CPS scores is more positive, the positive adjustment clinicians (all of the green dots) will have their payments scaled downward.

Since this value is not easy to predict (because we do not know ahead of time what the distribution of CPS scores will be), you may want to try various values of the budget neutrality scale factor to see how they would affect your reimbursement payments.

Got it - thanks!Based on what you have entered above, you are likely to see the following outcomes with MIPS and APM:

Why do MIPS reimbursement payments change over time?

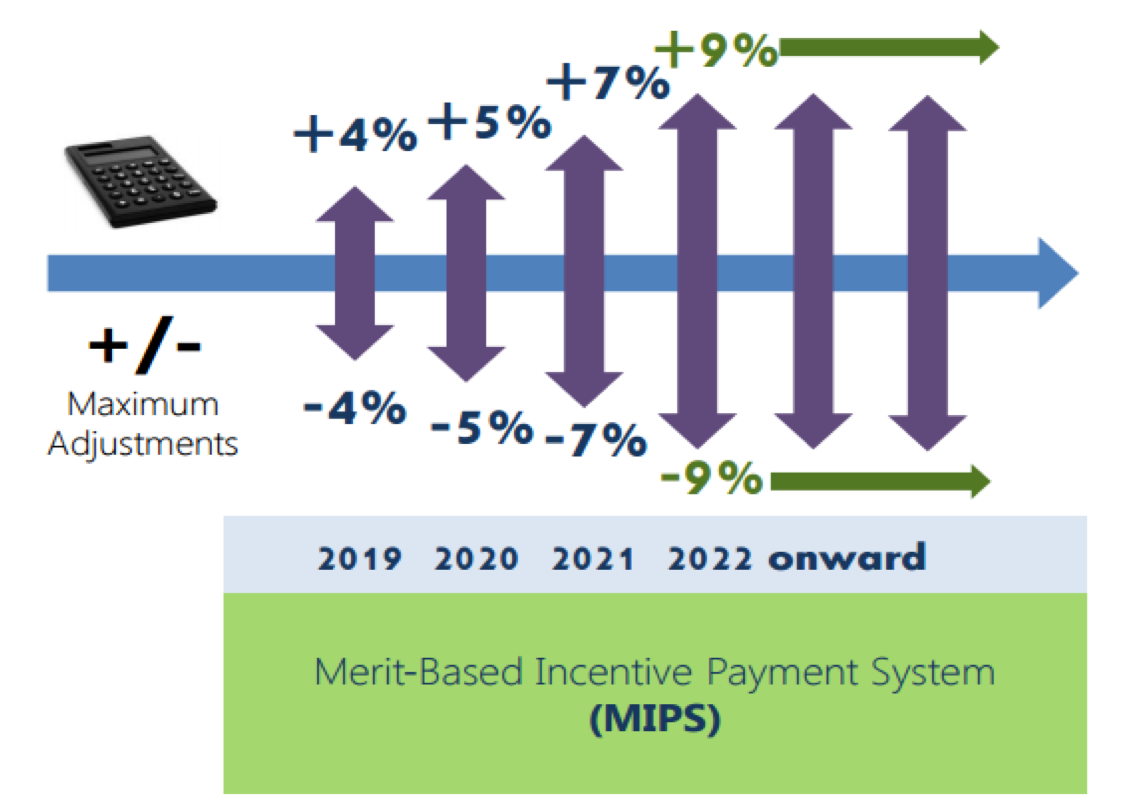

Starting in 2019, Medicare Part B clinicians will see payment adjustments in MIPS.

The range of possible payment adjustments will start at +/- 4% to clinicians’ Part B revenue but in the years that follow, the range of possible payment adjustments will increase in both directions.

Ultimately, the goal is to move away from standard fee-for-service payments. By increasing performance-based MIPS payment adjustments, this model is paying for value rather than paying for quantity of services provided.

Increasing MIPS risks and rewards also encourages a switch to alternative payment models, as MIPS clinicians will begin to see more and more risk.

Adjust these factors:

We hope that you find this calculator helpful, but you should take the time to carefully consider your own business needs and how they might impact this decision. In particular, you should keep in mind that:

- This calculator is valid for 'Advanced APMs' that qualify for incentive payments. APMs which do not qualify for incentive payments will receive a better scoring in MIPS, but it is difficult to calculate the potential upside and downside without further information.

- APMs and MIPS assumptions on this site are based on a proposed rule, so the calculations may change when the final rule is released (November 2016).

- Clinicians should also keep in mind the low-volume threshold: any individual eligible clinician or group who does not exceed the low-volume threshold (Medicare billing charges less than or equal to $10,000 AND provides care for 100 or fewer Part B-enrolled Medicare beneficiaries) will be exempt from MIPS.